- 地区:欧美

- 格式:PDF

- 文件大小:5M 无广告无水印

- 时间:

- 类别:华尔街

- 价格:4共享币

- 提示:本站推荐经典投资资料

本帖最后由 Money 于 2018-4-13 22:42 编辑 / k' B, V4 Q* N! n1 F' c

9 K% |# {' S! N m& U

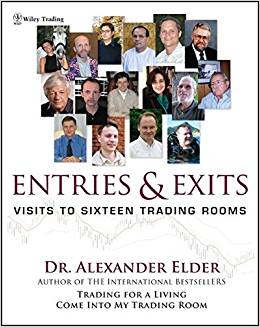

进场和出场参观16间交易室 ALEXANDER 亚历山大•艾尔德 中英文对照版 231页 无广告无水印

1 P) u, [& @8 ~, m; S游客,本下载内容需要支付 4共享币,购买后显示下载链接立即支付进场和出场参观16间交易室

/ H/ r( V3 i" Q; ?9 S! q% n! y 商品描述+ C- m2 g6 Z8 g, v% N/ N8 v A! O4 \

作者简介

" m% z9 b. h) P) T- P0 P7 x DR. ALEXANDER ELDER is a professional trader, a teacher of traders, and a practicing psychiatrist. He is the founder of elder.com, an educational firm for traders worldwide. Dr. Elder is the author of two international bestsellers, Trading for a Living and Come Into My Trading Room (and their companion study guides), both published by Wiley. He is an avid traveler, as chronicled in his book Straying from the Flock: Travels in New Zealand (Wiley).1 E! {7 ~- A, b# Q5 v- z' n

目录& b8 W5 C( p9 m5 I) l

Introduction.

# I' J& C8 E* q" f Chapter 1: Sherri Haskell A Logical Way of Looking at Things.

, l8 `- k+ _# h( ?) b8 |- P. A Chapter 2: Fred Schutzman My Computer Can Do the Trading for Me.9 c) W2 Y( r& `, f \2 d, A" U

Chapter 3: Andrea Perolo Simple Charts, Clear and Uncluttered.

8 P$ s; ?9 @7 F$ X9 v4 v7 V Chapter 4: Sohail Rabbani The Discipline of Loss Control.

( U; A W3 o9 D% W Chapter 5: Ray Testa Jr. Developing a Consistent Approach.

2 n' N6 v9 _7 A: A# z2 j Chapter 6: James (Mike) McMahon A Successful Engineer Has a Disadvantage.

) S' B( B% k" q9 r8 p9 r3 n+ c Chapter 7: Gerald Appel Looking for Favorable Probabilities.3 O0 x: j5 M, q6 e" s0 E

Chapter 8: Michael Brenke To Keep Repeating What I Did Right.: v% V: L; |: u! Z6 l* m

Chapter 9: Kerry Lovvorn A Squeeze Play.+ K6 T6 S5 \+ A2 G

Chapter 10: Dr. Diane Buffalin Dancing Like Fred Astaire, Only Going Backwards and in High Heels." p7 B/ X/ D+ H5 b- y/ O; @0 o+ t

Chapter 11: David Weis Price-Volume Behavior Is Steeped in Reality.* T/ k( z4 t% ~( P: x# _3 v' x3 s- ~

Chapter 12: William Doane The Bigger the Foundation, the Taller the Building." W" F5 M) U) g: @# \

Chapter 13: Peter Tatarnikov We Analyze People Who Analyze Markets., F; ] C( s* a( G/ B r

Chapter 14: Damir Makhmudov Technical Signals in the Fundamental Context.

! _* Q2 i3 e$ B0 R. g L+ U Chapter 15: Pascal Willain Effective Volume.% R9 n1 B# k& |! x6 p, a

Chapter 16: Martin Knapp Do It Right the Next Time Around.

8 H4 E# [; w, S9 d( L% C Conclusion.

2 S6 c/ Y% K; r Your Trading Room.. ^3 K3 a3 `# o0 @+ }, x9 w

Bibliography.

- {# n+ V3 r1 t/ }2 v Reading Lists.

4 U: p! o$ \9 c u" d2 v Acknowledgments.2 K( H0 m; P% a) r- ]& A9 w2 @8 I

About the Author.

% [# A7 Q+ Z1 k5 a6 I. t( G Index.

, W/ @$ N8 D* x' c. a+ l. Q You are about to meet 16 private traders. Some trade for a living, while others

8 h% @ N& y+ w are still at semiprofessional level, clawing their way to the upper rung. These; E' ]: C* K5 t" I

men and women live in different countries, trade different markets, and use- j0 m/ D9 t4 O ^

different methods, but all share several traits - most importantly their dedication8 ^ L# |3 F2 ^3 v

to trading. They are utterly serious about their work, while most amateurs, who$ m" M9 p; A& g3 m* d2 ]

supply the bulk of their winnings, are chasing the excitement of an adrenaline( i- Y* g: G$ B6 K9 {- ]

rush.! _* Y8 d. n8 N7 O

你会遇到16 位个人交易者。其中一些人已经是以交易为生了,其他人还是半个. T/ C! E; W6 [, I) |

专业人士,正在往上爬。这些人在不同的国家生活,在不同的市场交易,使用不

! Z0 i4 [1 @7 M+ u2 |9 c 同的方法,但是他们都有共同的特点——最重要的就是对交易的执着。虽然大部

3 L$ _, z5 \: V4 d2 S5 {/ Q( U# o 分都是业余选手,他们都对交易非常认真,都在追求交易的刺激,都想赢。3 b% j! f$ t* F/ f( x# n

The people you are about to meet have generously agreed to describe their( e/ j& K: [, C: g$ C

methods and show their actual trades. Why would they do that? Why would a

5 h; Y) @" B& F0 j9 l" {. K: W# T' j) D person who knows how to trade talk to anyone instead of keeping his or her! h* n5 t! x) S8 h0 i

mouth shut and grinding out profits in silence?( ?5 @, g, j. e! _( E( d, p+ ]- C

你将会遇到的这些人都同意描述他们的方法和实际的交易。他们为什么要这么% @0 E, K. p5 p! s+ g

做?为什么知道如何交易的人还要和别人讨论他们的交易呢,自己安静地赚钱不! f. m+ f: {, V

是更好吗?% d# ?. [$ H7 L9 Q2 x

The secret of trading is that there is no secret. There is no magic formula you

2 F* i! j/ e) _1 T+ h/ ^ can buy or steal and plug into your computer to automatically make money.

* ?6 S5 s* }' G- I k8 n Success is based on discipline, hard work, and a bit of flair. These traders o& Q+ m* o7 x0 |2 p

know that their success will not be diminished by the success of others, which

J+ g T4 c- e; h7 s is why they are willing to show you what they do. Also, many have traveled a8 ^! D- J/ w4 \' G7 ~7 }4 g6 X8 D- @

hard road and feel kind toward beginners.# l8 q# ]4 Y% P% U" R; N; x4 q

交易的秘诀就是没有秘诀。这个世界上并没有神奇公式,你买不到,也偷不到,' T* L5 n1 a; Q7 V% A

更不会装在电脑上能自动赚钱。成功建立在纪律、努力和一些天资的基础上。这

# w9 n0 F8 J, i- D0 {& N 些交易者明白别人的成功不会消灭他们的成功,所以他们愿意告诉你他们是怎么, v$ M+ G4 l* r. N; E ~$ J

做的。另外,很多人走了一段很艰难的路,现在感觉自己还是新手。

2 z! T6 C! U% ]1 r Trading is an immensely rich field, and no one can become an expert in all6 K* _- d$ X0 f- ~+ S& p2 { u t

aspects of it, just like a doctor cannot be an expert in every field of medicine.

* P0 Q& Q2 K# Q! E1 O/ m% T2 G Many beginners spread themselves painfully thin between investing and

! z( h4 A% L* B. x6 V! D- W' N5 N4 X day-trading, between stocks, futures, and options. You’re about to see that1 S- q7 V0 ]. ^6 f4 P2 w

almost all successful people find one area that appeals to them and specialize

) ]/ e/ ~) ~& C2 P& b in it.1 H! i* h- H7 C

交易是一个非常庞大的系统,一个人不可能了解它的方方面面,就要一个医学专

$ r3 H) d9 V' A: F 家不可能了解整个医学系统一样。很多新手在投资、日内交易、股票、期货和期 ^$ u% {, _' k( m1 ~

权中间痛苦地倒差价。你会发现最成功的人总是找到他最喜欢的领域,然后专攻# z+ {6 f9 n: j$ t2 w+ M; P

这个领域。6 e0 K1 I4 y6 J9 L

People become successful when they focus on what they love to do. In reading& N9 {9 K; B1 Y9 ~: J6 x& X- [

this book you will probably come across a trading vehicle you like or a concept

' @( r' f; z% F6 C1 { that appeals to you. Once you find it, stay with it and mine that area for its rich

7 o9 J+ S* d8 Z# G1 s8 y7 k# p2 ` deposits. I wrote this book to help you break out of isolation, learn from others,

& e2 S* t* i: U( w4 I" K8 f pick up ideas that suit your style, and return to your trading room a better, more& b0 K' i! S+ G- q

confident trader.

7 O* z7 A- a) a% k( o, C 当人们聚焦于他们最喜欢的工作时,他们才会成功。在阅读本书时,你也许会发 i; [: c: ~6 [2 b& W8 g$ {

现你最喜欢的交易工具或是你最喜欢的概念。一旦你发现了它,你要坚持使用它,* d8 T4 o( B% x4 I

并挖掘它的财富。我写这本书是为了帮助你打破限制,从其他人身上学习,找到

( u# G- z3 p( \ b2 B( E0 M 你的思路,把你的交易室变大,自己更自信。' d2 ~' A3 `' Y! n

HOW I MET THESE TRADERS- w% x$ t' i( ~; ?; z

5

- l0 s; L6 ^- {6 j 我是如何遇到这些交易者的7 |* q* m( A2 L+ ], M8 P+ G/ E

Eight years prior to writing this book, I went on a Caribbean vacation and by

, H) c M* q0 `9 L' X+ W the end of the week felt thoroughly bored. The blue sky, the warm beach, and

# m/ N, s3 b6 w. f5 ]8 X. H/ e the rich food became a little repetitive after a few days. I realized that my

; ^, |) e6 g) b9 ~ favorite vacation was a working trip during which I could alternate work with

4 K- l8 p3 k0 X( b. w sightseeing. I thought there must be others with similar tastes, and the

/ a2 E. \( H6 E7 S. a3 q* w following winter scheduled my first Traders’ Camp. Eighteen traders signed on,

* c/ l- `6 j7 X' [ and we went to the Dominican Republic for a week. We ran on the beach every' ~ F5 \" y" K6 o

morning, had classes from 9 AM to 1 PM and again from 5 to 6:30 PM, spent7 M0 M! [$ W6 m3 ]

several hours around the pool after lunch, and partied every night. The group

$ C9 d) w3 ?$ V9 w7 l k8 g loved the classes, the resort, and the company. They told their friends about

8 b; P) n5 N" y1 n, k& v7 I our Camp, and people started calling and asking to join. From then on we ran8 z' ]' R4 B/ L1 i) I) L ]! i

Traders’ Camps several times a year on islands in the Caribbean, Pacific, and& B4 p& ?. l/ f# {: o4 h

Mediterranean.

& @% ]. w+ d$ s( ? h& U* ^" _ 在我写本书的8 年前,我到加勒比海去度假,周末时我就觉得超级无聊了。几天$ R7 B" m, s* h- k% i& O/ L# i# s) d

后我就发现,这蓝天、温暖的海边和美食都有点重复。我意识到我最喜欢的假期5 h6 h/ C; s0 @& Y5 L* C

其实是出差,我可以一边工作,一边观光。我想有些人肯定也这么想,然后我就. F' S% i5 A! i5 K1 T

在冬天第一举办了交易者训练营。有18 位交易者报名,我们到多米尼加共和国" n9 e5 J7 _, S; i

待了一周。每天早上,我们在海边奔跑,上午9 点到下午1 点,晚上5 点到6 U* ]; D4 w, \

点半都是讲课,吃完饭后再游泳几个小时,晚上开派队。组员喜欢这些课程、度

4 S/ O& V) ]' ]% { @1 f# O+ m7 U 假胜地和伙伴。他们把训练营的事告诉了他们的朋友,然后就有更多的人打电话

, ]" N: F3 V4 A 给我,要求加入。从那时开始,我每年要在加勒比海、太平洋和地中海举办几次 i( e* G, H4 ?3 h9 e8 F

交易者训练营。1 C! n C# M/ t5 T

After working and playing together for a week, many campers became friends

+ e, ^& w$ p9 e/ a$ w' }4 G# I% `: f and kept in touch. I started having monthly campers’ meetings in my apartment8 L7 G: {0 x1 S. |3 M5 K

in New York. Many campers returned to subsequent Camps for refresher

$ u- B6 u+ N4 I2 i9 H0 W courses. After watching their progress over the years, I knew who I wanted to# k9 N! x3 s6 n

interview for this book. They included Sherri Haskell, Sohail Rabbani, Ray) d, k, B) T3 j& z8 D) j; h

Testa, Mike McMahon, Michael Brenke, Kerry Loworn, and Diane Buffalin. I

) m" Z5 |3 X" D7 B. b( C7 S* M# C would have interviewed several more, but we could not mesh our schedules.5 T( Z T; Y$ N

在一起一边工作,一边玩耍一周以后,很多学员成为了朋友并互相联系。于是我) E$ A2 r: d, P0 H6 ?

在纽约的公寓每个月和他们会面一次。很多学员会再次参加交易者训练营以学到

4 C& a" `; G$ i' l8 ~8 X, L 更新的课程。看着他们一年又一年地成长,我想我应该面谈他们,并写出本书。: x- {( |, a5 g! K

这些人包括雪瑞·哈斯克尔、苏海尔·拉巴尼、雷·特斯塔、麦克·马宏、迈克

2 y; R% w7 z& ~) b 尔·伯恩克、凯瑞·娄文和戴安·布法林。我还想多面谈几个,但是我们的时间

" p/ S& i; J( l7 Z3 L6 @5 Q: R, c 总对不上。9 L2 x, i- e t7 B& N, ~

I always invited at least one guest instructor to every Camp to offer a greater

# I6 X7 [, z9 r* p, B2 u. F! { diversity of views. I taught in the mornings, and they taught in the afternoons.

4 x# r1 Z9 J+ o% M; B6 S! a6 O Four people in this book - Fred Schutzman, Gerald Appel, David Weis, and

8 h! h7 W! ] y0 a6 I8 _& [ Martin Knapp - taught in two or more Camps. I kept inviting them back because8 d' `* y" `6 @

traders loved their lessons. As soon as I began working on this book, I knew I$ P" o- i+ P n! W# S, u- J

wanted to interview them.. t! }5 a* l3 ?; ?: q" r/ G( ]( s

6- l2 f/ `/ g' ?# D

我在举办训练营的时候总会邀请至少一名客座教练,这样就会有多种思想。我在5 b& Z6 N1 O' d% V

上午讲课,他们在下午讲课。本书中的——弗瑞德·舒兹曼、杰拉尔德·阿佩尔、

: y! v9 K# A9 X 大卫·维斯和马丁·纳普——至少讲课两次。我要不停地邀请他们,因为交易者

0 t) d. _5 p) \. q& \! ]% m8 d 喜欢他们的课程。当我写本书的时候,我知道我也要和他们面谈。

9 _' |' o. {: W I had been hearing of Bill Doane for several years and invited him for an

* C9 W2 f. p* X interview to expand outside the camper circle. I ran into Peter Tatarnikov in

/ X# C @' y* ], t: g Moscow and was impressed by the maturity and depth of this very young man;

# q' Z8 |5 P& c3 Z$ g2 ?+ Z we conducted an interview in his securely locked office a few days before I

4 d5 a/ V2 p) a9 c- F8 }# w flew back to New York.1 Z r% b# H# e

多年来我就听说了比尔·多恩,我曾经和他面谈过,谈论关于扩大训练营的事。9 e( |, [; z( s v

我到莫斯科找到了彼得·塔塔尼科夫,这个年轻人的成熟和深度让我印象深刻,

# F9 Q5 w7 Z: R* @ 我们在他高度戒备的办公室有过面谈,然后我就飞回纽约了。( t0 p$ K' A; ] a4 D9 r

MALE OR FEMALE? Almost every nonfiction writer faces this dilemma -

- @" P& m( p6 O* L# ^2 s0 S which pronoun to use. He? She? He or she?2 Y! P7 W2 t2 ?# v

他或她?只要不是写小说,每位作者都会遇到这个两难——用哪个人称。他?6 u* Q2 O/ q" a% P/ \% t

她?他或她?

* b3 s/ |) L: m8 P$ B* w7 t. m# L Male traders outnumber women, although the ratio is rapidly becoming more

; o9 ?1 R) L7 M3 f# {3 z1 R2 A balanced, as more and more women come into the markets. I find that the- h' G. M! @, v4 z- L+ R" b% M

percentage of successful traders is higher among women. They tend to be less

! k8 [ ?: p3 Z w& _: g$ K& A arrogant, and arrogance is a deadly sin in trading. The male ego - that% P3 O" J, h! G: y

wonderful trait that has been bringing us wars, riots, and bloodshed since time4 l' n+ M& n c2 I) x( w# Y4 n/ H

immemorial - tends to get heavily caught up in trading. A guy studies his charts,

& }1 r5 p6 d6 E) ?" ~4 C" n decides to buy, and now his self-esteem is involved - he has to be right! If the

# |/ x9 u5 p2 A$ z7 e+ V5 r' Q. } market goes his way, he waits to be proven even more right - bigger is better. If

/ y' q, }/ L: w+ i- y$ B2 u5 P the market goes against him, he is tough enough to stand the pain, and waits

1 n4 F, Q& M' z) i5 R for the market to reverse and prove him right - while it grinds down his account.

# j$ c% h+ M' R/ q# X 男性交易者比女性交易者多,但是随着女性交易者越来越多,这个比率快平衡了。

1 Q! ~5 v6 d. |! M7 p9 a 我发现女性交易者的成功比例高。她们一般很少自大,自大是交易的死罪。男性

! Z8 Q1 c& G5 a+ V/ c6 O5 ^ 的自负——自古以来这个伟大的特点给我们带来了战争、动乱和流血——在交易, g4 D$ T6 ^+ v& k

中则会被套。一个人研究了他的图表,决定去买,他开始自负了,他必须是正确

/ R5 G; E4 A" x' x 的!如果市场对他有利,他希望自己更加正确——越大越好。如果市场对他不利,! N/ ], b! o/ _. t$ s2 t9 e' X

他可以坚强地忍受痛苦,并等待市场反转,以证明他是对的——实际上他的账户

3 Q4 @* b0 m4 h) r; _ 被市场毁了。" a' D6 x3 p/ o0 a

Women traders, on the other hand, are much more likely to ask a simple

% O* N. P: W; O question: Where’s the money? They like to take profits and avoid losses

3 B# l0 {5 L) \3 u0 S( ^; u8 S5 ^* G instead of trying to prove themselves right. Women are more likely to bend with: {( S% @ a2 g- `' Z8 p) |' e4 h* F

the wind and go with the flow, catch trends, and hop off a little earlier, booking

, W' t, m6 I4 g4 @4 |$ d profits. When I tell traders that keeping records is a hugely important aspect of

l. o! ~+ R8 [7 N! S success, women are more likely to keep them than men. If you are looking to1 _& B& E$ ?5 e3 P) f

hire a trader, all other factors being equal, I’d recommend looking for a woman.5 h7 z$ T% v6 S1 F

7

, o5 v7 Q- Y# |4 b. M M 相反,女性交易者会问简单的问题——钱在哪里?她们喜欢利润,关注的焦点是

. R: b( n3 J7 E 避免损失,她们不是为了证明自己是对的。女人喜欢顺风顺水,抓住趋势,提前

* ~' x5 `4 I; A* ]( ~- A* N* h 起飞,实现利润。当我告诉交易者们做交易记录是非常有利于成功的,女性交易$ B# V0 s v9 C9 a9 M$ p( }

者要比男性交易者做的好。如果你在寻找交易者,其它方面条件都一样,我建议4 W. V* B. ~1 M0 S' a; [% I

你选择女性。: m7 U7 c# v) g

Still, there are many more male than female traders. The English language

0 T$ {+ r% M) ^; `5 y* m9 o; d being what it is, “he” flows better than “he or she” or even jumping between the

7 N6 @2 a8 R/ q- C0 s, Y two pronouns. To make reading easier, I’ll use the masculine pronoun. } I w9 E6 P% z' W. G* c0 w

throughout this book. I trust you understand that no disrespect is intended

4 p# g8 J/ k* U towards women traders. I want to make this book easier to read for everybody," ^1 M- S: i* }

of any gender, anywhere in the world.

0 h# S; {+ D5 j3 ^& U+ _ 然而,男性交易者还是比女性交易者多。在英语中,用“他”比用“他或她”的+ }. r. D- s* ?

概率高多了。为了阅读方便,我在本书中也用“他”。我希望你明白,我并没有

$ I5 N& r5 z0 m* x- W& U 不尊重女性交易者的意思。我只是为了全世界的人阅读的方便,不管是谁,不管( r$ ~+ @: Z! M" O- Y9 N* K

性别,不管在哪里。6 o9 V) c2 s( k+ D9 N/ A6 p

$ D) S( f" r |& c

7 W! F1 l5 U& ?8 r* D7 T T

|

相关帖子聚合推荐

-

1Study Guide for Entries & Exits进场和出场(学习指导手册)

-

Study Guide for Entries & Exits进场和出场(学习指导手册)

**** 本内容需购买 ****

商品描述

作者简介

DR. ALEXANDER ELDER is a professional trader, a teacher of traders, and a practicing psychiatrist. He is the founder of elder. ...

|